In the Sunshine State, the seller pays for the deed’s document stamp tax and the buyer covers the mortgage stamp and intangible tax. In Florida, the buyer and seller split the taxes related to filing the mortgage and deed, commonly called a transfer tax or document stamp.

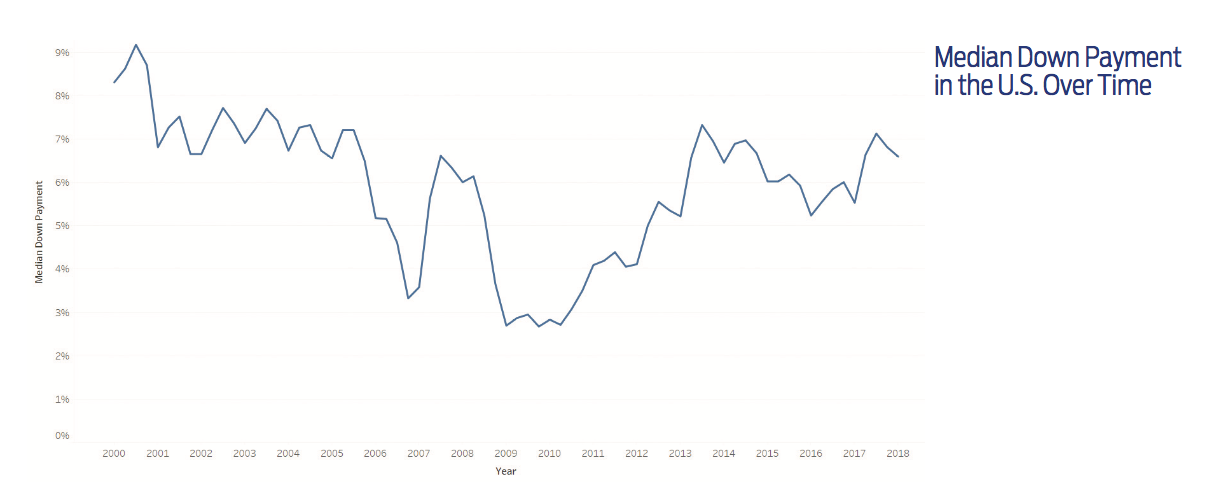

The Orlando market has the most competition for homes in the $400,000 to $450,000 range and less at the higher end, so you may find buyers more willing to contribute to closing costs if you’re buying an $800,000 house rather than a $400,000 house, Stelljes adds.įlorida has a few traditions about who pays what closing costs. “I’m finding that sellers definitely understand that we’re in a little bit of a different market.” “If you see a listing that’s been on the market for more than two weeks, you’ll have a better chance of negotiating some sort of closing costs contributions that maybe you can use to buy down the rate,” she notes. “We still have a busy market here in Orlando, but sellers may be willing to give a little if needed to get their home sold,” says real estate agent Kathryn Stelljes, who has worked with over 65% more single-family homes than the average agent in Orlando. But you will be responsible for a variety of charges, some that vary based on your loan amount and others that may be a flat fee.ĭepending on local customs and how well or slowly homes are selling, the seller may agree to pay for some of your closing costs. As a buyer, you don’t have to worry about the real estate commission, which the seller typically pays and their agent and your agent split. federal housing administration loans, for example, require only 3.5 percent down.Closing costs run the gamut, from origination fees for your mortgage to the real estate commission agents charge. However, few people have that much cash available to them, and you can get away with much less. A 20 percent down payment is considered the optimum amount by many lenders.

Unless you come up with a 20 percent down payment or get a second. afford to buy a home requires a lot more than finding a home in a certain price range. The calculator will estimate your monthly principal and interest payment, which. For example, if you buy a home for $200,000 and you have a 20% down payment, you’ll pay your lender $40,000 at closing. Most lenders calculate your down payment as a percentage of your loan value. You pay your down payment to your lender when you close on your mortgage. One of the downfalls of this program, however, is that you still have to pay mortgage insurance premiums to protect the lender if you default on your loan.Ī down payment is the first payment you make on your mortgage loan. One of the most popular of the low-down payment loans is a Federal Housing Administration, which allows for a 3.5 percent down payment. Finley and Kerry each can afford to spend about $925 a month on a house payment, excluding taxes and homeowners insurance. You have a lot of downpayment programs.Īre you thinking of applying for a mortgage for a home in Colorado, but not sure how much to put as a down payment? Click here to find out what the average down payment on a house in 2019 is.įrom Reuters: German fashion house Hugo Boss cut its 2019 earnings forecast again, citing weak demand in the United States and Hong Kong, and reported third quarter results that were below its.īigger down payment = more house. Also, most of our downpayment loans are payment deferred-meaning no payment is due until the mortgage is paid off or until you sell, transfer, move out of or refinance the property. Home Down Payment Org It is wrapped into your main home mortgage, so you don’t have two bills to pay.

20% will get you out of mortgage insurance, but remember, you will still have closing costs, so your $100k could be $110k out of pocket. Instead of typical, let’stalk about appropriate. However, high-end homebuyers contributed higher-than-average down payments of more than 20 percent. The average down payment nationwide in 2014 was 14 percent. industrial A down payment is often the biggest challenge buyers face when purchasing a home, especially first-time homebuyers. But realistically you should expect to need a 20.Ĭontents big action step wells fargo (wfc Mortgage interest rates White house. conventional rehab loans can technically be done with as little as 5 percent down. This is the website all the lenders use!The fha 203k rehab program only requires a 3.5 percent down payment.

#AVERAGE DOWN PAYMENT ON A HOUSE IN FLORIDA HOW TO#

Conventional Down Payment How To Get Down Payment Assistance For A House 2019 Down Payment Assistance Florida | Up to $15,000 dollars – Searching for 2019 Down Payment Assistance in Florida? Free Grant & Down Payment Information available in Florida.

0 kommentar(er)

0 kommentar(er)